It doesn’t get much better than this past year. 2019 will be remembered as a year in which investors were amply rewarded for risks taken. Few can remember a year when pretty much everything worked and the positive momentum carried right through to year-end. Despite trade friction, political wrangling, Federal Reserve indecision, and another year of slow but steady economic growth, continuous pump priming and easy money conditions carried the day. Investors, whether in equities or fixed income, had another rewarding year with no end in sight to a bull market that is entering into its 12th year. Trees don’t grow to the sky, but it doesn’t feel like it’s over yet. Volatility connected to the coronavirus is a wake-up call as we move further into 2020.

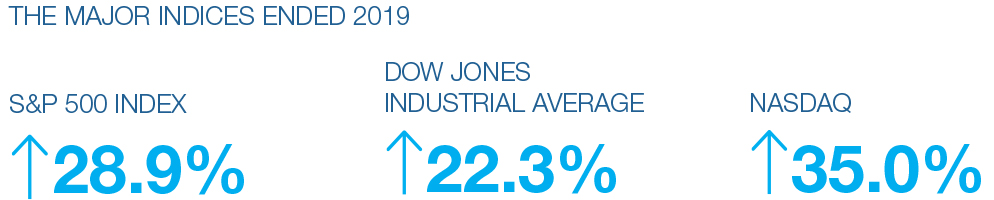

When we began 2019, we were coming off a year of elevated market volatility and a 14 percent drop in the S&P 500 index in the fourth quarter of 2018. Right out of the gate, investors re-evaluated risk and despite rising interest rates early in the year, and driven by strong performance in the technology sector, the market produced a return by the S&P 500 of 29 percent, closely matched by the DJIA of 22 percent and Nasdaq of 35 percent. The markets chose to ignore the significant rancor out of Washington, the trade turmoil, and the continued violence emanating from disrupted societies around the world.